The Main Principles Of Transaction Advisory Services

Table of ContentsRumored Buzz on Transaction Advisory ServicesSome Known Factual Statements About Transaction Advisory Services What Does Transaction Advisory Services Mean?Getting My Transaction Advisory Services To WorkThe Facts About Transaction Advisory Services Revealed

This step makes certain the business looks its finest to potential customers. Getting the business's value right is important for an effective sale.Transaction advisors step in to assist by obtaining all the required details organized, responding to inquiries from buyers, and setting up brows through to the service's area. Transaction experts utilize their knowledge to assist company owners manage hard arrangements, satisfy purchaser expectations, and framework bargains that match the owner's objectives.

Meeting lawful regulations is essential in any kind of company sale. Transaction consultatory solutions collaborate with lawful specialists to produce and review agreements, agreements, and various other legal documents. This decreases risks and sees to it the sale follows the law. The role of deal experts expands beyond the sale. They help organization proprietors in preparing for their next steps, whether it's retirement, beginning a brand-new endeavor, or managing their newly found wide range.

Deal experts bring a wide range of experience and expertise, making certain that every facet of the sale is managed professionally. Through strategic preparation, assessment, and arrangement, TAS assists company proprietors attain the highest feasible sale rate. By guaranteeing legal and regulative conformity and handling due persistance along with various other offer staff member, transaction advisors lessen potential risks and obligations.

The 9-Second Trick For Transaction Advisory Services

By comparison, Huge 4 TS groups: Service (e.g., when a possible purchaser is performing due diligence, or when a deal is closing and the customer requires to integrate the firm and re-value the vendor's Annual report). Are with costs that are not linked to the deal shutting effectively. Make fees per engagement somewhere in the, which is less than what investment banks earn also on "small deals" (however the collection chance is likewise a lot higher).

, but they'll concentrate much more on accountancy and valuation and less on topics like LBO modeling., and "accountant just" topics like test balances and just how to stroll through events using debits and credit go to the website ratings instead than financial declaration adjustments.

A Biased View of Transaction Advisory Services

that demonstrate how both metrics have altered based upon items, channels, and consumers. to judge the accuracy of management's past forecasts., consisting of aging, stock by item, typical levels, and provisions. to identify whether they're completely imaginary or somewhat credible. Experts in the TS/ FDD teams might likewise talk to administration regarding every little thing over, and they'll create a thorough report with their findings at the end of the procedure.

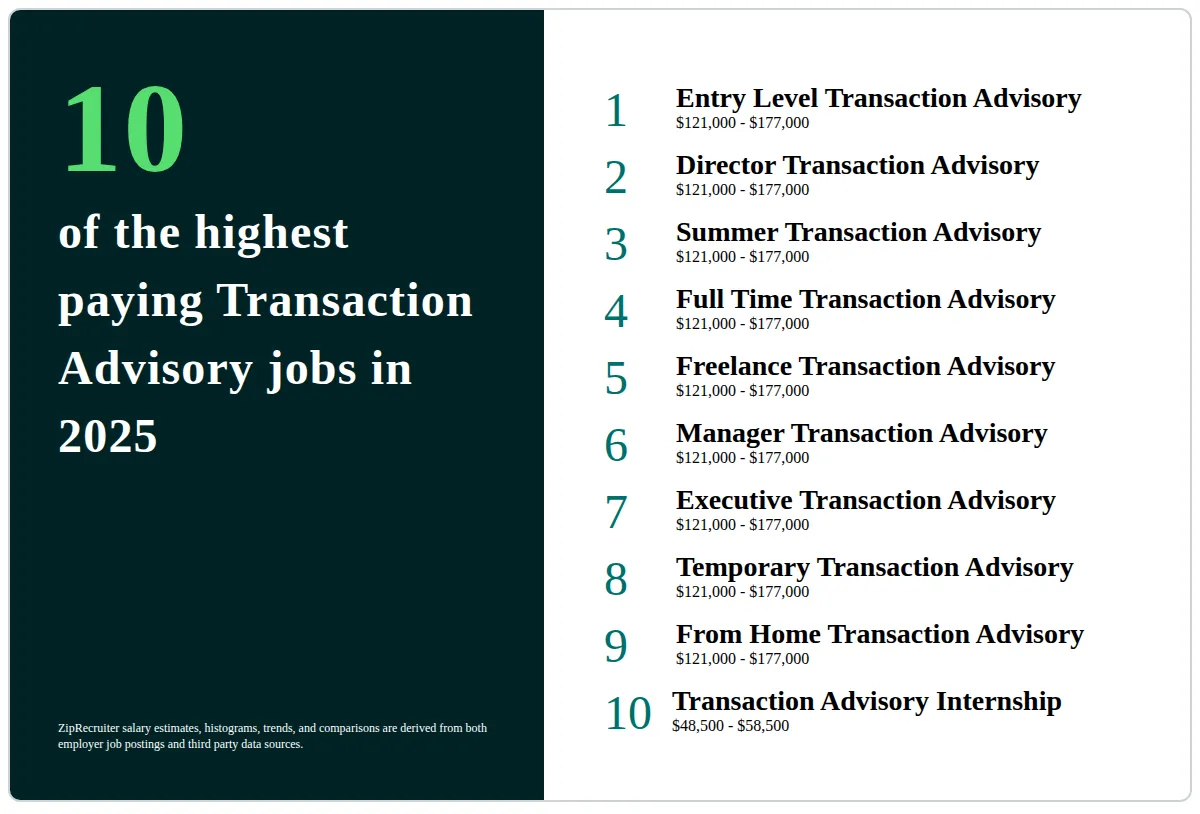

, and the basic shape looks like this: The entry-level role, where you do a great deal of data and economic evaluation (2 years for a promotion from here). The following level up; comparable job, yet you get the more interesting little bits (3 years for a promotion).

Particularly, it's hard to get promoted beyond the Manager level because few people leave the task at that stage, and you require to start revealing evidence of your capacity to generate profits to advance. Let's start with the hours and way of living considering that those are easier to define:. There are occasional late evenings and weekend work, however nothing like the frantic nature of investment banking.

There are cost-of-living modifications, so expect reduced payment if you're in a cheaper place outside major financial centers. For all placements except Partner, the base income makes up the mass of the complete settlement; the year-end bonus offer could be a max of 30% of your base wage. Often, the most effective method to boost your earnings is to change to a go to this website various firm and work out for a higher salary and bonus offer

Some Ideas on Transaction Advisory Services You Need To Know

At this stage, you ought to simply remain and make a run for a Partner-level function. If you desire to leave, perhaps move to a client and do their valuations and due diligence in-house.

The main problem is that since: You generally need to join an additional Large 4 team, such as audit, and job there for a few years and afterwards relocate right into TS, work there for a few years and afterwards move right into IB. And there's still no assurance of winning this IB role because it depends on your region, customers, and the hiring market at the time.

Longer-term, there is additionally some risk of and since assessing a business's historic economic info is not precisely rocket science. Yes, people will constantly require to be entailed, however with even more advanced modern technology, reduced headcounts can content possibly support customer interactions. That stated, the Purchase Solutions group defeats audit in terms of pay, job, and departure possibilities.

If you liked this write-up, you might be thinking about analysis.

Some Ideas on Transaction Advisory Services You Need To Know

Create innovative economic structures that help in identifying the actual market price of a firm. Provide advising job in relation to service assessment to help in bargaining and prices structures. Discuss one of the most appropriate form of the offer and the type of consideration to utilize (cash, supply, make out, and others).

Perform combination planning to determine the process, system, and organizational modifications that might be called for after the bargain. Set guidelines for incorporating departments, modern technologies, and service processes.

Identify possible reductions by minimizing DPO, DIO, and DSO. Evaluate the prospective consumer base, sector verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence provides essential insights right into the functioning of the company to be acquired concerning risk assessment and worth creation. Recognize temporary adjustments to financial resources, banks, and systems.